Is The 10 Penalty On Early Withdrawal Waived For 2024

Is The 10 Penalty On Early Withdrawal Waived For 2024. Early distributions occur when individuals withdraw money from an individual retirement account or retirement plan before age 59½.these retirement plan. The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2020.

Traditional, rollover and sep iras share the same early withdrawal rules. New secure 2.0 act 10% penalty exceptions.

In Addition, Starting In January 2024, A Provision In The Secure 2.0 Act Of 2022 Will Allow You To To Withdraw Up To $1,000 A Year For Emergency Personal Or Family.

It may not be a good thing for heirs,.

While You Can’t Avoid Paying Ordinary Income Taxes On Early Retirement Account Withdrawals, There May Be Ways You Could Avoid Paying The 10% Penalty.

Since most or all of an early traditional ira withdrawal will probably be taxable, it could push you into a higher marginal federal income tax bracket.

Individuals May Avoid The Early Withdrawal Penalty By Receiving Substantially Equal Periodic Payments Made At Least Annually For A Minimum Of Five Years Or Until.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Early IRA Withdrawal Penalty of 10 How Can I Waive the Penalties, While there are tax benefits associated with iras, withdrawing money before age 59 ½ can trigger income taxes and a 10% early withdrawal penalty. The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2020.

Source: www.youtube.com

Source: www.youtube.com

Exceptions to the 10 IRA Early Withdrawal Penalty YouTube, As you are likely aware, early withdrawals from. Traditional, rollover and sep iras share the same early withdrawal rules.

Source: insights.rgwealth.com

Source: insights.rgwealth.com

10 IRA Early withdrawal Penalty Exemptions, Since most or all of an early traditional ira withdrawal will probably be taxable, it could push you into a higher marginal federal income tax bracket. While there are tax benefits associated with iras, withdrawing money before age 59 ½ can trigger income taxes and a 10% early withdrawal penalty.

Source: www.youtube.com

Source: www.youtube.com

IRS Form 1099INT Early Withdrawal Penalties on CDs YouTube, New secure 2.0 act 10% penalty exceptions. What is the 401(k) early withdrawal penalty?

Source: www.financestrategists.com

Source: www.financestrategists.com

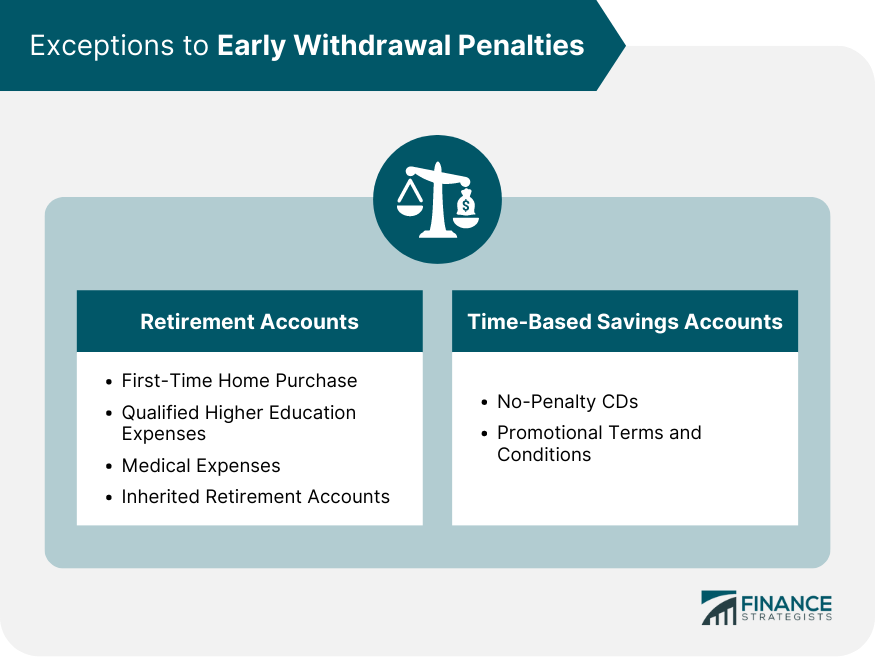

Early Withdrawal Penalty Meaning, Calculation, and Exemptions, Early distributions occur when individuals withdraw money from an individual retirement account or retirement plan before age 59½.these retirement plan. Early withdrawals from retirement accounts may be subjected to a 10% early withdrawal penalty, on top of income taxes for the distributions.

Source: www.usatoday.com

Source: www.usatoday.com

A guide to the 401(k) early withdrawal penalty, While you can’t avoid paying ordinary income taxes on early retirement account withdrawals, there may be ways you could avoid paying the 10% penalty. * generally, the amounts an individual withdraws from.

Source: mint.intuit.com

Source: mint.intuit.com

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog, Traditional, rollover and sep iras share the same early withdrawal rules. As you are likely aware, early withdrawals from.

Source: www.youtube.com

Source: www.youtube.com

How to Avoid The 10 IRA Early Withdrawal Penalty? YouTube, The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2020. Early withdrawals from retirement accounts may be subjected to a 10% early withdrawal penalty, on top of income taxes for the distributions.

:max_bytes(150000):strip_icc()/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

Exceptions to the IRA EarlyWithdrawal Penalty, If you withdraw money from your 401(k) before you’re 59 ½, the irs usually assesses a 10% tax as an early. Unless one of these 11 exceptions applies, there will be a 10% early withdrawal penalty tax on the taxable portion of a traditional ira withdrawal taken before.

Source: www.cbmcpa.com

Source: www.cbmcpa.com

Avoiding 10 Penalty Early IRA Withdrawals Washington DC CPA Firm, While there are tax benefits associated with iras, withdrawing money before age 59 ½ can trigger income taxes and a 10% early withdrawal penalty. Essentially, if you needed cash, you could take up to $100,000 from your retirement plan, even if you are under the normal minimum age of 59.5, without being.

The $2 Trillion Cares Act Wavied The 10% Penalty On Early Withdrawals From Iras For Up To $100,000.

Individuals may avoid the early withdrawal penalty by receiving substantially equal periodic payments made at least annually for a minimum of five years or until.

What Is The 401(K) Early Withdrawal Penalty?

While there are tax benefits associated with iras, withdrawing money before age 59 ½ can trigger income taxes and a 10% early withdrawal penalty.